Enterprise risk management and business continuity represent complementary disciplines that, when properly integrated, create comprehensive organizational resilience capabilities. While ERM focuses on identifying, assessing, and managing risks across the entire organization, business continuity and risk management integration ensures that continuity planning directly supports broader risk management objectives.

Understanding the strategic relationship between these disciplines enables organizations to optimize resource allocation, improve decision-making, and build more effective resilience capabilities that protect stakeholders while supporting business objectives.

Understanding the ERM and Business Continuity Relationship

What is the Difference Between BCP and ERM?

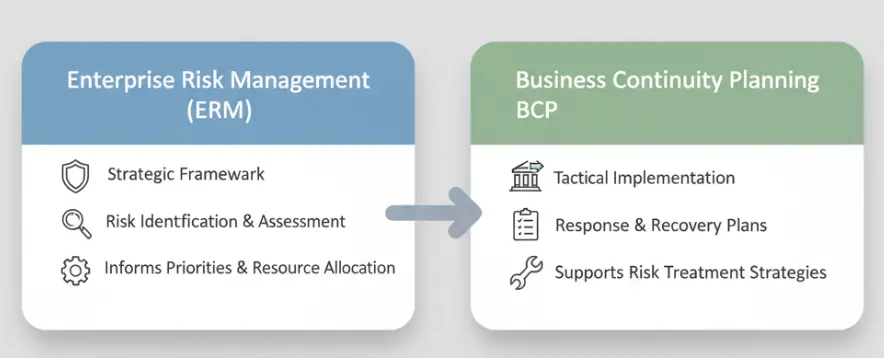

Enterprise Risk Management (ERM) and Business Continuity Planning (BCP) serve distinct but complementary purposes in organizational risk management:

Enterprise Risk Management Focus:

- Strategic Scope: Addresses all organizational risks including strategic, operational, financial, and compliance risks across the entire enterprise

- Risk Treatment: Emphasizes risk identification, assessment, treatment, and monitoring through various strategies including acceptance, mitigation, transfer, and avoidance

- Business Integration: Integrates risk considerations into strategic planning, operational decisions, and performance management across all organizational levels

- Governance Focus: Provides Board and executive leadership with comprehensive risk visibility and management oversight capabilities

Business Continuity Planning Focus:

- Operational Scope: Concentrates specifically on maintaining critical business functions during and after disruptive events

- Recovery Treatment: Emphasizes preparation for, response to, and recovery from specific disruption scenarios through predetermined procedures

- Incident Integration: Focuses on tactical response capabilities and operational recovery procedures for specific threat scenarios

- Response Focus: Provides operational teams with detailed procedures and capabilities for maintaining operations during disruptions

Complementary Relationship:

- ERM provides the strategic risk framework that informs BCP priorities and resource allocation decisions

- BCP provides the tactical implementation that supports ERM risk treatment strategies for business interruption risks

- Together, they create comprehensive risk management capabilities that address both strategic risk governance and operational response readiness

What is Business Continuity and Risk Management?

Business continuity and risk management represents the integrated approach that combines strategic risk oversight with operational continuity capabilities:

Integrated Definition: The systematic process of identifying organizational risks, assessing their potential business impact, and implementing both risk mitigation strategies and continuity capabilities that protect critical functions while supporting overall business objectives.

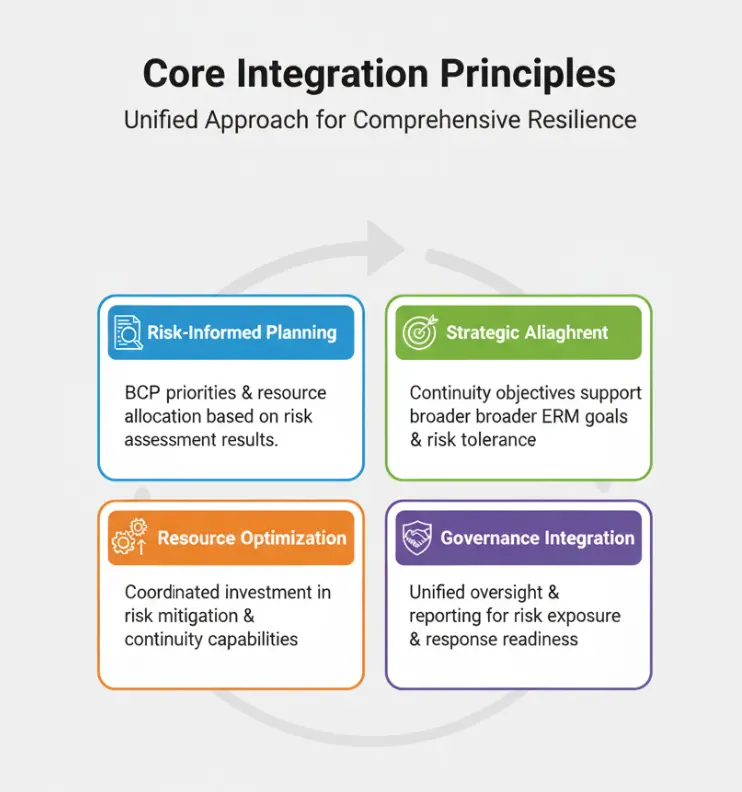

Core Integration Principles:

- Risk-Informed Planning: Business continuity priorities and resource allocation decisions based on comprehensive risk assessment results rather than intuitive or compliance-driven approaches.

- Strategic Alignment: Continuity objectives directly support broader enterprise risk management goals including risk tolerance, appetite, and treatment strategies.

- Resource Optimization: Coordinated investment in risk mitigation and continuity capabilities that maximize protection while minimizing costs and resource duplication.

- Governance Integration: Unified oversight and reporting that provides leadership with comprehensive view of both risk exposure and response readiness.

Strategic Value of Integration

Organizational Benefits:

Enhanced Decision-Making: Integrated risk and continuity information enables better strategic decisions about risk treatment, resource allocation, and capability investments.

Resource Efficiency: Coordinated approach eliminates duplication and optimizes investments in risk management and continuity capabilities.

Improved Performance: Organizations with integrated ERM-BCP approaches achieve 34% better incident response performance and 28% faster recovery times.

Stakeholder Confidence: Comprehensive risk management approach builds greater confidence with customers, investors, regulators, and other stakeholders.

Regulatory Compliance: Integrated approach facilitates compliance with regulations requiring both risk management and continuity planning capabilities.

Strategic Integration Framework

Alignment Principles and Methodologies

Fundamental Integration Principles:

Risk-Based Prioritization: All business continuity activities prioritized based on enterprise risk assessment results ensuring continuity investments address highest-priority organizational risks.

Strategic Coherence: Continuity objectives aligned with overall enterprise risk strategy including risk appetite, tolerance levels, and treatment preferences.

Governance Alignment: Unified governance structure that coordinates risk management and continuity oversight avoiding conflicts and ensuring consistent direction.

Resource Coordination: Integrated resource planning that optimizes investments across risk mitigation and continuity capabilities while avoiding unnecessary duplication.

Information Integration: Shared risk intelligence and continuity performance data that informs both strategic risk decisions and operational response capabilities.

Implementation Methodology

Phase 1: Assessment and Alignment (Months 1-3)

Current State Analysis:

- Evaluate existing ERM and BCP capabilities including policies, procedures, and governance structures

- Identify gaps, overlaps, and integration opportunities between current risk management and continuity practices

- Assess organizational culture and readiness for integrated risk and continuity management approaches

Strategic Alignment:

- Align continuity objectives with enterprise risk strategy including risk appetite statements and treatment preferences

- Integrate continuity considerations into enterprise risk taxonomy and classification systems

- Establish unified governance structure with clear roles and responsibilities for integrated oversight

Phase 2: Framework Development (Months 4-6)

Integrated Methodology Design:

- Develop combined risk assessment and business impact analysis procedures that support both ERM and BCP objectives

- Create unified risk and continuity reporting frameworks that provide comprehensive perspective for decision-makers

- Design integrated performance measurement systems that track both risk management effectiveness and continuity readiness

Process Integration:

- Integrate continuity planning into enterprise risk assessment and treatment processes

- Embed risk considerations into continuity strategy development and resource allocation decisions

- Align risk monitoring and continuity testing activities for comprehensive organizational preparedness assessment

Phase 3: Implementation and Optimization (Months 7-12)

System Implementation:

- Deploy integrated risk and continuity management systems including shared databases and reporting platforms

- Implement unified governance processes including combined oversight committees and reporting procedures

- Execute training programs that build integrated risk and continuity competencies across organizational levels

Performance Optimization:

- Monitor integration effectiveness through performance metrics and stakeholder feedback

- Refine processes based on lessons learned and emerging best practices

- Establish continuous improvement procedures for ongoing optimization of integrated capabilities

Governance Structure Integration

Unified Governance Framework:

Board-Level Integration:

- Combined risk and audit committee oversight for both ERM and BCP activities

- Unified reporting that provides comprehensive view of risk exposure and response readiness

- Strategic decision-making that considers both risk treatment options and continuity requirements

Executive Management:

- Chief Risk Officer and Business Continuity leadership coordination and collaboration

- Executive team accountability for both risk management performance and continuity readiness

- Strategic planning integration that addresses risk and continuity considerations in organizational strategy

Operational Management:

- Department-level risk and continuity coordinators working collaboratively on integrated planning

- Operational risk assessment that directly informs continuity planning and resource allocation

- Performance management that includes both risk management and continuity objectives

How Does Business Continuity Fit Into an Enterprise Risk Management Plan?

Business continuity serves multiple critical functions within comprehensive enterprise risk management frameworks:

Risk Treatment Strategy Implementation

Continuity as Risk Mitigation:

Impact Reduction: Business continuity capabilities reduce the potential impact of risk events by enabling organizations to maintain operations during disruptions.

Recovery Acceleration: Continuity planning enables faster recovery from risk events, reducing total impact and cost of business interruptions.

Residual Risk Management: Continuity capabilities manage residual risks that remain after other risk treatment strategies have been implemented.

Confidence Building: Demonstrated continuity capabilities build stakeholder confidence in organizational ability to manage risks effectively.

Risk Monitoring and Early Warning

Integrated Risk Intelligence:

Threat Monitoring: Continuity planning includes threat monitoring capabilities that support broader enterprise risk assessment and early warning systems.

Vulnerability Assessment: Business impact analysis and continuity assessments identify vulnerabilities that inform enterprise risk registers and treatment strategies.

Performance Indicators: Continuity testing and exercise results provide performance indicators that inform enterprise risk management effectiveness measurement.

Incident Learning: Continuity plan activations and incidents provide learning opportunities that enhance overall enterprise risk understanding and management.

Strategic Risk Portfolio Management

Risk Treatment Optimization:

Cost-Benefit Analysis: Continuity capabilities provide alternative risk treatment options that may be more cost-effective than other mitigation strategies.

Risk Diversification: Continuity planning addresses multiple risk scenarios simultaneously, providing diversification benefits for enterprise risk portfolios.

Capability Leveraging: Continuity capabilities developed for specific risks often provide benefits for managing other risk scenarios and organizational challenges.

Strategic Flexibility: Robust continuity capabilities provide strategic options during risk events including opportunity capture and competitive advantage development.

What is the Relationship Between BCM and Risk Management?

Business Continuity Management (BCM) and Risk Management maintain symbiotic relationship where each discipline enhances and informs the other:

Information and Intelligence Sharing

Risk Intelligence Flow:

ERM to BCM: Enterprise risk assessments inform continuity planning priorities, resource allocation, and strategy development ensuring continuity efforts address highest-priority organizational risks.

BCM to ERM: Continuity assessments and testing results inform enterprise risk understanding including vulnerability identification and impact assessment refinement.

Shared Databases: Integrated risk and continuity databases that eliminate information silos and provide comprehensive organizational risk and readiness visibility.

Coordinated Monitoring: Combined monitoring systems that track both risk indicators and continuity readiness providing comprehensive early warning capabilities.

Resource and Capability Coordination

Integrated Investment Strategy:

Shared Infrastructure: Technology investments that support both risk monitoring and continuity capabilities including communication systems and data backup solutions.

Personnel Development: Cross-training programs that build both risk management and continuity competencies within the same personnel resources.

Vendor Coordination: Shared vendor relationships and contracts that provide both risk management services and continuity support capabilities.

Facility Integration: Physical resources that support both risk management operations and continuity response including emergency operations centers.

Performance and Improvement Coordination

Unified Performance Framework:

Integrated Metrics: Performance measurement systems that track both risk management effectiveness and continuity readiness using coordinated indicators and benchmarks.

Combined Testing: Exercise programs that test both risk management procedures and continuity capabilities through realistic scenario simulations.

Shared Learning: Lessons learned programs that capture insights from both risk events and continuity activations for improvement of both disciplines.

Coordinated Reporting: Management and board reporting that provides comprehensive view of organizational risk and continuity performance.

Integrated Risk Assessment and BIA

Combined Methodology Approaches

Unified Assessment Framework:

Risk-Informed Business Impact Analysis:

- BIA process that incorporates comprehensive risk assessment results ensuring impact analysis addresses all relevant risk scenarios

- Risk likelihood consideration in BIA priority setting ensuring resources focus on most probable and impactful scenarios

- Dynamic impact assessment that adjusts based on changing risk landscape and emerging threat intelligence

- Multi-dimensional impact analysis that addresses financial, operational, strategic, and reputational consequences

Continuity-Enhanced Risk Assessment:

- Risk assessment that considers continuity capabilities in likelihood and impact evaluation

- Residual risk calculation that accounts for existing continuity capabilities and planned improvements

- Risk treatment option evaluation that includes continuity strategies alongside other mitigation approaches

- Scenario analysis that incorporates continuity response capabilities in risk impact modeling

Risk Tolerance and Continuity Objectives Alignment

Integrated Objective Setting:

Risk Appetite Translation: Enterprise risk appetite statements translated into specific continuity objectives including maximum acceptable downtime and recovery performance standards.

Tolerance Threshold Integration: Risk tolerance levels directly informing Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO) for critical business functions.

Performance Standards Alignment: Continuity performance standards that reflect organizational risk tolerance and support broader risk management objectives.

Resource Allocation Optimization: Risk-based resource allocation that balances prevention, mitigation, and recovery investments based on comprehensive cost-benefit analysis.

Priority Alignment Frameworks

Unified Prioritization Methodology:

Risk-Based Function Prioritization: Critical function identification based on enterprise risk assessment results ensuring continuity efforts protect highest-value and highest-risk organizational capabilities.

Impact Severity Integration: Business impact severity calculations that incorporate both operational disruption and strategic risk implications for comprehensive priority setting.

Recovery Sequencing: Recovery priority sequences that address both operational dependencies and risk management objectives including reputation protection and stakeholder confidence.

Resource Allocation Logic: Systematic resource allocation methodology that optimizes protection across both immediate operational needs and long-term strategic risks.

ERM-Driven Recovery Strategy Selection

Risk-Informed Decision Making

Strategic Recovery Planning:

Risk Treatment Integration: Recovery strategies selected based on enterprise risk treatment preferences including risk acceptance, mitigation, transfer, and avoidance strategies.

Multi-Scenario Planning: Recovery strategies that address multiple risk scenarios efficiently rather than single-threat approaches that may not provide comprehensive protection.

Cost-Risk Optimization: Recovery strategy selection based on cost-risk analysis that considers both implementation costs and risk reduction benefits over time.

Strategic Flexibility: Recovery strategies that provide options and adaptability rather than rigid procedures enabling response to various risk scenarios and changing circumstances.

Resource Allocation Frameworks

Integrated Investment Strategy:

Risk-Based Budgeting: Continuity investment allocation based on enterprise risk priority and treatment strategies ensuring resources address highest-priority organizational risks.

Capability Leveraging: Recovery investments that provide multiple benefits including risk mitigation, operational efficiency, and strategic capability enhancement.

Partnership Optimization: External partnership strategies that provide both risk management services and continuity capabilities through coordinated vendor relationships.

Technology Integration: Technology investments that support both risk monitoring and continuity capabilities including predictive analytics and automated response systems.

Performance Measurement Coordination

Unified Success Metrics:

Risk Reduction Measurement: Continuity capability effectiveness measured through risk reduction achieved rather than just recovery performance indicators.

Cost-Benefit Tracking: Economic analysis that tracks both risk management value and continuity capability benefits providing comprehensive ROI assessment.

Strategic Impact Assessment: Performance measurement that includes both operational recovery effectiveness and strategic risk management contribution.

Stakeholder Value Creation: Success measurement that includes stakeholder confidence, regulatory compliance, and competitive advantage achieved through integrated capabilities.

Governance and Oversight Integration

Board-Level Integration

Unified Board Oversight:

Integrated Reporting: Board reporting that provides comprehensive view of both enterprise risk exposure and continuity readiness eliminating information silos and coordination gaps.

Strategic Decision Support: Board decision-making framework that considers both risk treatment options and continuity requirements in strategic planning and resource allocation.

Performance Accountability: Board oversight that holds management accountable for both risk management effectiveness and continuity capability development and maintenance.

Stakeholder Communication: Unified stakeholder communication that addresses both risk management performance and continuity readiness building comprehensive confidence.

Management Reporting Alignment

Executive Dashboard Integration:

Comprehensive Risk Visibility: Management reporting that combines risk indicators and continuity readiness metrics providing complete organizational preparedness perspective.

Performance Trending: Historical performance tracking that identifies trends in both risk management effectiveness and continuity capability development.

Exception Reporting: Alert systems that identify both emerging risks and continuity capability gaps requiring management attention and resource allocation.

Decision Support Analytics: Advanced analytics that support management decisions by combining risk intelligence with continuity performance data.

Technology and Data Integration

Shared Risk Databases

Integrated Information Systems:

Unified Risk Repository: Centralized database that stores both enterprise risk information and continuity planning data enabling comprehensive analysis and reporting.

Real-Time Data Integration: Automated data sharing between risk management and continuity systems ensuring information currency and consistency across disciplines.

Historical Data Management: Long-term data retention that supports trend analysis, predictive modeling, and lessons learned integration for both risk and continuity management.

Access Control Coordination: Security and access control systems that maintain data integrity while enabling appropriate access for both risk and continuity personnel.

Integrated Monitoring Systems

Comprehensive Surveillance:

Multi-Purpose Sensors: Monitoring systems that provide data for both risk assessment and continuity activation including environmental sensors and system performance monitors.

Alert Integration: Unified alert systems that notify both risk management and continuity teams of relevant events and threshold breaches requiring coordinated response.

Predictive Analytics: Advanced analytics that use both risk and continuity data to predict potential issues and recommend proactive interventions.

Performance Dashboards: Real-time dashboards that display both risk indicators and continuity readiness status providing comprehensive organizational preparedness visibility.

Implementation and Maturity Models

Integration Roadmap Development

Systematic Integration Approach:

Maturity Assessment: Current state evaluation of both ERM and BCP capabilities including integration readiness and improvement opportunities.

Gap Analysis: Identification of integration gaps and improvement priorities based on organizational needs and industry best practices.

Phased Implementation: Systematic rollout plan that builds integration capabilities progressively while maintaining operational effectiveness.

Change Management: Comprehensive change management approach that addresses cultural, process, and technology changes required for successful integration.

Continuous Improvement Processes

Ongoing Enhancement:

Performance Monitoring: Regular assessment of integration effectiveness including both quantitative metrics and qualitative feedback from stakeholders.

Benchmarking: Comparison with industry best practices and peer organizations to identify improvement opportunities and validate current approaches.

Innovation Integration: Systematic evaluation and adoption of new technologies, methodologies, and best practices that enhance integrated capabilities.

Learning Culture: Organizational learning processes that capture insights from both successful integration activities and areas requiring improvement.

Enterprise risk management and business continuity integration creates comprehensive organizational resilience that protects stakeholders while enabling competitive advantages through superior risk management and response capabilities. By understanding what is business continuity and risk management integration and implementing systematic approaches to how does business continuity fit into an enterprise risk management plan, organizations build strategic capabilities that provide both immediate protection and long-term value creation.

The most successful organizations don’t treat ERM and BCP as separate compliance activities—they recognize the strategic value of integration and invest in unified approaches that optimize resource allocation while building superior organizational resilience. What is the relationship between BCM and risk management is ultimately about creating synergistic capabilities that enable organizations to thrive through uncertainty while maintaining strategic focus and operational excellence.

Success requires commitment to systematic integration, stakeholder engagement, and continuous improvement that builds organizational capabilities aligned with both risk management objectives and operational resilience requirements. The investment in integrated ERM-BCP capabilities pays dividends not only during crises but through improved decision-making, resource efficiency, and strategic positioning that supports long-term organizational success.